Get the

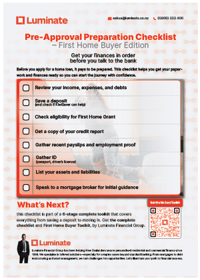

Pre-Approval Preparation

Checklist

Why Pre-Approval Preparation Matters

Getting your documents and finances in order before applying makes the mortgage process faster, less stressful, and more likely to succeed. Banks and brokers want to see that you’re organised and financially stable — if you have everything ready, they can give you a clearer answer sooner. This also means you’ll know exactly what you can afford before you start house hunting.

NZ Lending Criteria at a Glance

When lenders assess your application, they’ll typically look at:

-

Deposit size – Most buyers aim for 20%, but some lenders may accept 10% (or 5% with a First Home Loan).

-

Income-to-debt ratio – Your income vs. existing debt is tested to ensure repayments are manageable.

-

Spending habits – Regular expenses and discretionary spending can impact borrowing power.

-

Credit history – A record of your borrowing and repayment behaviour.

-

Stability – Employment history, savings consistency, and overall financial discipline.

Common Mistakes to Avoid

Many buyers lose time or weaken their application by:

-

Forgetting to check their credit report for errors or unpaid accounts.

-

Inconsistent savings records — large unexplained deposits or irregular savings habits can raise questions.

-

Applying before debt is under control (credit cards, car loans, buy-now-pay-later).

-

Not shopping around — going with the first lender instead of comparing options.